skip to main |

skip to sidebar

Risk assets and oil.

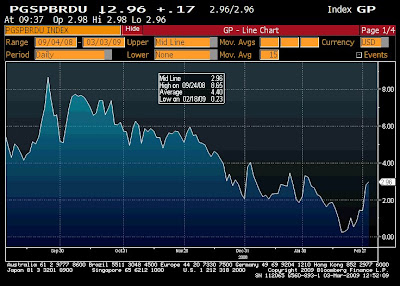

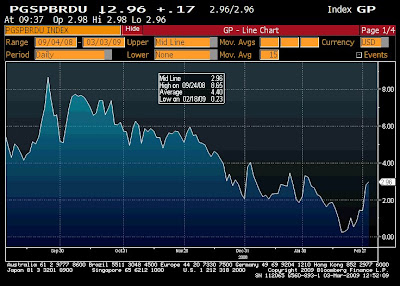

In the meltdown yesterday, SFOT finds 2 moves of interest within commodities and fx. 1) The fact that Gold has not been the safe haven asset over the past 3 trading days strikes me as that it is not going to push above $1000 this round amongst whisper of cash needed for margins and also india demand for gold has fallen out of bed. 2) Safe haven currencies CHF,JPY are not strengthening a lot in this environment vs commodity currencies, AUD, CAD. With this in mind, SFOT is likely to favour buying the pair AUDCHF with a fairly tight stop below 0.73. Also, Gold is probably not a buy now and he shall wait for the trend to turn before taking the dive. Back to the oil complex, Brent crude recovered from its low of yesterday. With Opec meeting drawing near and the latest headline from Nigeria on explosion of a shell pipeline reminding us of the risk, SFOT will add another unit length to the slightly deferred price, and keeps his long spreads position in Brent. Gasoline cracks continue to hold firm and as we head into another DOE day tomorrow, SFOT notice that the sweet sour differential has widened out again towards $3. SFOT also hears that the east-west arbitrage for Fuel oil is now closed, hence fuel oil cracks should be under slight pressure.

Back to the oil complex, Brent crude recovered from its low of yesterday. With Opec meeting drawing near and the latest headline from Nigeria on explosion of a shell pipeline reminding us of the risk, SFOT will add another unit length to the slightly deferred price, and keeps his long spreads position in Brent. Gasoline cracks continue to hold firm and as we head into another DOE day tomorrow, SFOT notice that the sweet sour differential has widened out again towards $3. SFOT also hears that the east-west arbitrage for Fuel oil is now closed, hence fuel oil cracks should be under slight pressure.

the chf has its own problems re the US try to break open the swiss banking system. if the usa allow the swiss banks to stay secret the CHF will bounce very hard .....

ReplyDeletethe aud is it more hope than fact ? .. the credit crunch is just starting there... tricky one

@ Richard, agree with the CHF story and how the US plays a big role in determining CHF going fwd and probably is a big explanation to why it has not done very much. On AUD, my humble take is that it is a commodity index and a proxy china play. That they didnt cut rate surely means they would like to have a little more time to see how China and the rest of the world comes out of it, and they can afford the time needed for more assessment, i.e it is all not that bad, YET.

ReplyDelete