As we approach the end of Q1, SFOT takes a look at the coming summer and what might be in store, starting with the Airline industry. Air france announced a loss for this fiscal year and predicts another loss for next year. Europe's biggest airline's results illustrate the tough environment for this industry in the next 2 years and with prices firming from here, no wonder their shares are down 6% this morning. For choice, SFOT will be short Airlines but have not quite made up his mind which industry he would like to be long against airlines, but certainly not financials! He is not about to let his little equity fun take over his main focus though.

What he wants to point out is that airlines as a community are starting hedge their Jet fuel consumption more actively again. This is especially the case for summer based Charter airlines in europe, a phenomenon that happened last year that took the jet forward curve to a shape never seen before. However, a lot of them got into trouble hedging at over $100 per barrel and some never survived past 2008 when margin calls came. Good luck to them this time round. While the forward curve is going a little higher, the front end, which is more physical related is also being bid higher by physical players looking to buy more Jet fuel for storage. And as long as the contango stays here, making it viable to store Jet fuel on floating storage, there may appear to be a decent underlying bid in Jet fuel, but this will not last forever.

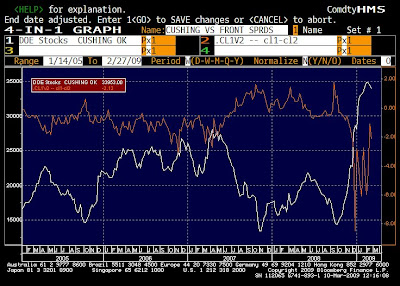

Jet vs Gasoil in Europe

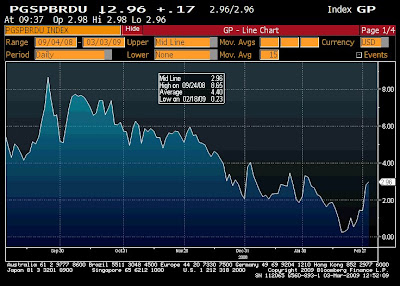

That financial players are mainly responsible for prices to rally this past 2 weeks are certainly a foregone conclusion. One look at the simple chart of EUR/USD agsint WTI might even suggest prices to be at least 10% higher and the financial guys would probably be happy to keep length, or at least not add to shorts. End users jumping on the trend can be further deduced by that open interest further out the curve has increased by almost 30% over the month of March. Now that EUR has seen some weakness today, Crude price has indeed followed suit. The end of the quarter may bring no new risk but come next week, or next month, we shall see if the price level here holds. A lot will depend on Equities and the performance of USD but if those do not hold up, we could see a very hard puke in Oil prices. A 50/45 putspread in K9 WTI costs around 1.25 just for a taster.